Filter by

SubjectRequired

LanguageRequired

The language used throughout the course, in both instruction and assessments.

Learning ProductRequired

LevelRequired

DurationRequired

SkillsRequired

SubtitlesRequired

EducatorRequired

Results for "tax laws"

University of Illinois Urbana-Champaign

Skills you'll gain: Certified Public Accountant, Labor Law, Labor Relations, Law, Regulation, and Compliance, Regulation and Legal Compliance, Contract Review, Vendor Contracts, Organizational Structure, Corporate Accounting, Business, Contract Management, Regulatory Requirements, Sales

University of Pennsylvania

Skills you'll gain: Compliance Management, Law, Regulation, and Compliance, Business Ethics, Internal Controls, Risk Analysis, Financial Controls, Auditing, Ethical Standards And Conduct, Risk Management Framework, Due Diligence, Employee Training, Policy Development, Global Marketing, International Relations

Skills you'll gain: Payroll, Payroll Tax, Sales Tax, Balance Sheet, Accounting, Accounts Payable, Financial Accounting, General Accounting, Equities, Bookkeeping, General Ledger, Mortgage Loans, Tax, Loans, Financial Statements

Status: Free

Status: FreeUniversity of Geneva

Skills you'll gain: Contract Review, Coordinating, Contract Management, Contract Negotiation, Strategic Partnership, Conflict Management, Risk Control, Law, Regulation, and Compliance, Asset Management

University of Illinois Urbana-Champaign

Skills you'll gain: Management Accounting, Operations Management, Marketing, Process Improvement, Marketing Management, Organizational Strategy, Performance Measurement, Marketing Planning, Supply Chain Management, Product Strategy, Manufacturing Operations, Operational Analysis, Business Operations, Cost Accounting, Supply Chain Planning, Integrated Marketing Communications, Strategic Marketing, Marketing Strategy and Techniques, Variance Analysis, Accounting Systems

Status: Free

Status: FreeUniversity of Pennsylvania

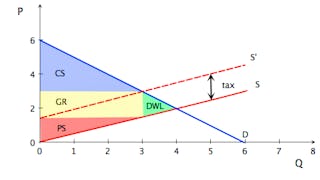

Skills you'll gain: Supply And Demand, Economics, Market Dynamics, Market Analysis, Resource Allocation, Policy Analysis, Tax, Consumer Behaviour, Cost Benefit Analysis, Decision Making

University of Pennsylvania

Skills you'll gain: Operations Management, Operational Efficiency, Process Analysis, Operational Performance Management, Process Improvement, Lean Methodologies, Workflow Management, Continuous Improvement Process, Capacity Planning, Quality Management, Business Workflow Analysis, Supply Chain Management, Inventory Management System, Statistical Process Controls, Process Flow Diagrams, Root Cause Analysis

Skills you'll gain: Security Controls, Information Assurance, Cybersecurity, Risk Management Framework, Information Systems Security, Security Awareness, Cyber Governance, Security Management, Cyber Security Policies, Cyber Risk, Data Ethics, Data Integrity

Status: NewStatus: Free

Status: NewStatus: FreeUniversity of Lausanne

Skills you'll gain: Mergers & Acquisitions, Equities, Tax, Accounting, Accounts Receivable, Financial Market, Income Tax, Inventory Accounting, Financial Management, Asset Management, Financial Accounting, Depreciation, Investments, Corporate Finance, Balance Sheet, Financial Statements, Financial Reporting, Cash Flows

Macquarie University

Skills you'll gain: Business Strategy, Design Thinking, Supply Chain, Strategic Thinking, Business Strategies, Supply Chain Planning, Business Ethics, Supply Chain Management, Corporate Sustainability, Customer Analysis, Emerging Technologies, Organizational Strategy, Strategic Sourcing, Environmental Social And Corporate Governance (ESG), Governance, Transportation, Supply Chain, and Logistics, Innovation, Business Modeling, Business Transformation, Business Management

Lund University

Skills you'll gain: Law, Regulation, and Compliance, Artificial Intelligence, Labor Law, Regulatory Compliance, Innovation, Criminal Investigation and Forensics, Information Privacy, Public Administration, Healthcare Industry Knowledge, Predictive Modeling, Health Care

DeepLearning.AI

Skills you'll gain: Generative AI, OpenAI, PyTorch (Machine Learning Library), Artificial Intelligence and Machine Learning (AI/ML), Deep Learning, Tensorflow, Artificial Intelligence, Applied Machine Learning, Scalability, Natural Language Processing, Machine Learning Methods, Application Deployment, Computer Architecture, Software Architecture, Systems Architecture, Reinforcement Learning, Performance Tuning, Distributed Computing, Benchmarking, Application Performance Management

In summary, here are 10 of our most popular tax laws courses

- Corporate & Commercial Law I: Contracts & Employment Law: University of Illinois Urbana-Champaign

- What is Corruption: Anti-Corruption and Compliance: University of Pennsylvania

- Liabilities and Equity in Accounting: Intuit

- Rédaction de contrats: University of Geneva

- Value Chain Management: University of Illinois Urbana-Champaign

- Microeconomics: The Power of Markets: University of Pennsylvania

- Introduction to Operations Management: University of Pennsylvania

- Security Principles: ISC2

- Accounting 2: University of Lausanne

- Strategising: Management for Global Competitive Advantage: Macquarie University