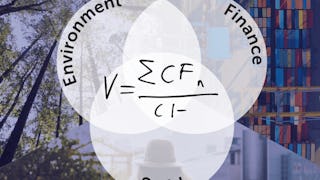

This course introduces you to the rapidly evolving world of sustainable finance and its transformative role in driving positive environmental and social impact. You'll explore how sustainable finance differs from traditional finance and discover the key products and instruments that are reshaping the financial landscape, from green bonds to sustainability-linked loans and impact investing.

Sustainable Finance: Products, Instruments and Future Trends

This course is part of The Intersection of Finance, Strategy, and Sustainability Specialization

Instructor: Amir Amel-Zadeh

Included with

Recommended experience

What you'll learn

Fundamental principles of sustainable finance and how it differs from traditional finance, including key products and strategies driving the market.

How financial institutions and organisations are using sustainable finance instruments to achieve both financial returns and positive impact.

How to select appropriate sustainable finance solutions by understanding their features, benefits, and potential applications in different contexts.

Details to know

Add to your LinkedIn profile

February 2025

1 assignment

See how employees at top companies are mastering in-demand skills

Build your subject-matter expertise

- Learn new concepts from industry experts

- Gain a foundational understanding of a subject or tool

- Develop job-relevant skills with hands-on projects

- Earn a shareable career certificate

Earn a career certificate

Add this credential to your LinkedIn profile, resume, or CV

Share it on social media and in your performance review

There are 4 modules in this course

This section contains the course curriculum and the video introduction to the course by your instructor. The video explores sustainable finance, focusing on innovative financial products and instruments that drive positive environmental and social change. Learn about green bonds, impact investing, and emerging trends that are transforming how organisations channel capital towards sustainable development whilst maintaining robust financial returns.

What's included

1 video1 reading

This module introduces learners to the rapidly growing field of sustainable finance, exploring the key products, tools, and strategies for aligning financial systems with sustainability goals. Learners will examine the roles of investors, banks, and other financial institutions in driving the transition to a low-carbon, sustainable economy.

What's included

12 videos1 discussion prompt6 plugins

This module provides a deep dive into the various sustainable financial products and services available to businesses and investors. Learners will explore the characteristics, benefits, and challenges of different instruments, such as green bonds, sustainability-linked loans, and impact investments, and the process of developing and implementing sustainable finance strategies.

What's included

12 videos1 reading1 assignment1 peer review1 discussion prompt6 plugins

This concluding video reflects on the journey through sustainable finance, exploring innovative financial instruments and their impact on global sustainability. From green bonds to impact investing, learners have discovered how financial products can channel capital towards sustainable development whilst incentivising responsible organisational practices.

What's included

1 video

Instructor

Recommended if you're interested in Finance

Erasmus University Rotterdam

Erasmus University Rotterdam

Saïd Business School, University of Oxford

Saïd Business School, University of Oxford

Why people choose Coursera for their career

New to Finance? Start here.

Open new doors with Coursera Plus

Unlimited access to 10,000+ world-class courses, hands-on projects, and job-ready certificate programs - all included in your subscription

Advance your career with an online degree

Earn a degree from world-class universities - 100% online

Join over 3,400 global companies that choose Coursera for Business

Upskill your employees to excel in the digital economy

Frequently asked questions

Access to lectures and assignments depends on your type of enrollment. If you take a course in audit mode, you will be able to see most course materials for free. To access graded assignments and to earn a Certificate, you will need to purchase the Certificate experience, during or after your audit. If you don't see the audit option:

The course may not offer an audit option. You can try a Free Trial instead, or apply for Financial Aid.

The course may offer 'Full Course, No Certificate' instead. This option lets you see all course materials, submit required assessments, and get a final grade. This also means that you will not be able to purchase a Certificate experience.

When you enroll in the course, you get access to all of the courses in the Specialization, and you earn a certificate when you complete the work. Your electronic Certificate will be added to your Accomplishments page - from there, you can print your Certificate or add it to your LinkedIn profile. If you only want to read and view the course content, you can audit the course for free.

If you subscribed, you get a 7-day free trial during which you can cancel at no penalty. After that, we don’t give refunds, but you can cancel your subscription at any time. See our full refund policy.

More questions

Financial aid available,